Money laundering in Nevada is defined as disguising the financial proceeds from illegal activity to make it appear that the money is coming from a legitimate source. Under 18 U.S.C. §§ 1956 and 1957, money laundering is a federal crime punishable by:

- up to 20 years in federal prison,

- a fine of up to $500,000 or two times the value of the laundered property – whichever is greater,

- restitution, and

- asset forfeiture.

In this article, our Las Vegas criminal defense attorneys discuss:

- 1. Definition

- 2. Elements

- 3. Penalties

- 4. Defenses

- 5. Statute of limitations

- 6. In the news

- 7. Helpful links

Federal law prohibits engaging in financial transactions with proceeds from certain criminal activities.

1. Definition

In Nevada, the legal definition of money laundering is knowingly camouflaging the source of unlawfully obtained money. Most money laundering progresses in three steps:

- Placement: Cash generated from illegal activity gets placed into the financial system. An example is taking money from selling drugs and depositing it into a credit union.

- Layering: The “placed” money is used (“layered”) in at least one financial transaction in order to disguise the money’s origin. An example would be converting drug money into other denominations/bills or currencies.

- Integration: The “layered” money gets handed out to one or more people as wealth. For example, the person who helps change drug money into different denominations may retain a cut of it (a “commission”) before giving back the rest of it to the drug dealers.

Money laundering is a crime even if none of the three steps involves a financial institution or business. Simply taking cash acquired from a crime and physically handing it to someone else could count as a money laundering transaction as long as you meant to hide the cash’s source.

Also, there is no minimum cash amount necessary to commit money laundering in Nevada. You can still be prosecuted even if your attempt to launder money fails. Plus the money can take any form, such as:

- cash,

- money orders,

- checks, or

- other negotiable instruments.1

10 common money laundering schemes

- Bank capture: Transferring money through a financial institution in which the alleged money launderers hold a controlling interest.

- Black salaries: Using laundered money to compensate unregistered employees.

- Bulk cash smuggling: Depositing criminal proceeds of more than $10,000 into an offshore bank or other financial institution to avoid reporting requirements. This violates the Bank Secrecy Act.

- Cash-intensive business: A business is created to receive unlawfully obtained cash that it then declares as lawful earnings. This is also called “washing money” or “cleaning money.”

- Real estate: Purchasing land or structures with criminal proceeds and then selling it, oftentimes to a family member with no criminal history. This is one of the more difficult schemes for law enforcement to trace.

- Structuring (“Smurfing”): Dividing bank account deposits into lower amounts to evade monetary transaction reporting requirements.

- Tax evasion: Not reporting to the IRS money transactions greater than $10,000.

- Trade-based laundering: Masking cash flow by undervaluing invoices, overvaluing invoices, or double-invoicing. This is also called “cooking the books.”

- Trusts and shell companies: These mechanisms allow money to be stored without divulging the true owner.

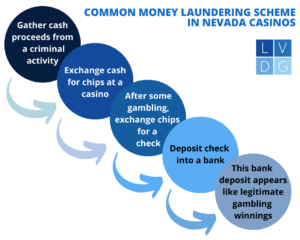

- Laundering through casinos: Converting cash from a crime into chips, and then converting it back to cash or a check. This is especially prevalent in Las Vegas and throughout Nevada due to legal gambling.

2. Elements

The key element in Nevada money laundering cases is that the money came from specified unlawful activities (SUAs). SUAs include nearly every serious federal crime such as:

- child pornography

- drug crimes (including drug trafficking or manufacturing controlled substances)

- export and trading violations

- extortion, theft, or embezzlement

- human trafficking

- murder, kidnapping, robbery, or other violent criminal conduct

- racketeering / organized crime (RICO)

- terrorism

- white-collar fraud crimes (such as mail fraud, wire fraud, and/or bank fraud)

The other elements of money laundering vary depending on whether the incident involved:

- domestic money laundering within the United States;

- international money laundering involving a foreign country; and/or

- money laundering stings.

The elements also turn on whether you are being accused of:

- promoting SUAs,

- concealing SUAs, or

- evading reporting requirements.2

Federal courts have jurisdiction over money laundering cases in Nevada that affect interstate or foreign commerce.

3. Penalties

Depending on the specific charges, federal money laundering convictions carry criminal penalties of:

- Up to twenty (20) years in federal prison (which is not located in Nevada); and/or

- Up to $500,000 in fines or twice the value of the property involved in the money laundering scheme (whichever is greater).

You may also be ordered to pay victim restitution. Plus the government may try to freeze and forfeit your assets that were obtained through money laundering.3

Note that money laundering cases often include multiple related charges depending on the case, such as:

- bank fraud

- credit card fraud

- cryptocurrency offenses

- drug trafficking

- mortgage fraud

- securities fraud

4. Defenses

Here at Las Vegas Defense Group, we have represented literally thousands of people charged with white-collar crimes such as money laundering. In our experience, the following three defenses have proven very effective with prosecutors, judges, and juries:

- No money laundering occurred. Merely being in possession of money generated from criminal activity is not – in and of itself – money laundering. If the U.S. Attorney’s Office cannot prove beyond a reasonable doubt that you made a financial transaction with the profits of an underlying crime, then the money laundering charge should be dropped. (Note you could still be prosecuted for any underlying offense or related fraud crimes.)

- You had no intent to money launder. Carrying out a financial transaction with proceeds from a crime qualifies as money laundering only if you intend for the transaction to disguise the source of the money. As long as the federal prosecutor cannot prove beyond a reasonable doubt that you intended to money launder, then you may be liable for any underlying crime – but not for laundering.

- The police committed misconduct. Federal law enforcement authorities frequently carry out elaborate undercover operations when investigating an alleged money laundering case. If the police may have overstepped their bounds by conducting an illegal search, we can file a motion to suppress evidence that asks the federal court to disregard all the illegally obtained evidence. If the court complies, the government’s case against you may be too weakened to proceed.

Typical evidence in money laundering cases includes video- and audio recordings from undercover police or informants, financial statements and records of financial transactions, currency transaction reports, and expert testimony by financial forensic experts.

5. Statute of limitations

The statute of limitations for federal prosecutors to bring federal money laundering charges in Nevada is five (5) years after the alleged crime.5

6. In the news

- Nevada man sentenced for money laundering, fraud after using COVID relief funds to buy $400K home – 8NewsNow (October 12, 2023)

- Operations manager at Las Vegas Strip resort accused of stealing $773K in money laundering scheme – Fox News (September 9, 2023)

- Las Vegas man sentenced to nearly 4 years in a Missouri prison for illegally selling steroids online – KTTN (June 23, 2023)

- Las Vegas resident charged in $45 million metaverse scam that touted trillion-dollar returns – CNBC (May 19, 2023)

- Las Vegas lawyer indicted for orchestrating a $460 million Ponzi scheme in NV, AZ, CA, UT – Fox News (March 31, 2023).

7. Helpful links

- Department of Justice – money laundering and asset recovery

- Department of the Treasury – money laundering

- Financial Crimes Enforcement Network – History of Anti-Money Laundering (AML) Laws

- Financial Action Task Force (FATF)

Arrested? Contact our Las Vegas Federal Crimes Lawyer to discuss your case.

Legal References

- Money Laundering Control Act of 1986 – 18 U.S.C. 1956 – Laundering of monetary instruments

(a)

(1) Whoever, knowing that the property involved in a financial transaction represents the proceeds of some form of unlawful activity, conducts or attempts to conduct such a financial transaction which in fact involves the proceeds of specified unlawful activity—

(A)

(i) with the intent to promote the carrying on of specified unlawful activity; or

(ii) with intent to engage in conduct constituting a violation of section 7201 or 7206 of the Internal Revenue Code of 1986; or

(B) knowing that the transaction is designed in whole or in part—

(i) to conceal or disguise the nature, the location, the source, the ownership, or the control of the proceeds of specified unlawful activity; or

(ii) to avoid a transaction reporting requirement under State or Federal law,

shall be sentenced to a fine of not more than $500,000 or twice the value of the property involved in the transaction, whichever is greater, or imprisonment for not more than twenty years, or both. For purposes of this paragraph, a financial transaction shall be considered to be one involving the proceeds of specified unlawful activity if it is part of a set of parallel or dependent transactions, any one of which involves the proceeds of specified unlawful activity, and all of which are part of a single plan or arrangement.

(2) Whoever transports, transmits, or transfers, or attempts to transport, transmit, or transfer a monetary instrument or funds from a place in the United States to or through a place outside the United States or to a place in the United States from or through a place outside the United States—

(A) with the intent to promote the carrying on of specified unlawful activity; or

(B) knowing that the monetary instrument or funds involved in the transportation, transmission, or transfer represent the proceeds of some form of unlawful activity and knowing that such transportation, transmission, or transfer is designed in whole or in part—

(i) to conceal or disguise the nature, the location, the source, the ownership, or the control of the proceeds of specified unlawful activity; or

(ii) to avoid a transaction reporting requirement under State or Federal law,

shall be sentenced to a fine of not more than $500,000 or twice the value of the monetary instrument or funds involved in the transportation, transmission, or transfer, whichever is greater, or imprisonment for not more than twenty years, or both. For the purpose of the offense described in subparagraph (B), the defendant’s knowledge may be established by proof that a law enforcement officer represented the matter specified in subparagraph (B) as true, and the defendant’s subsequent statements or actions indicate that the defendant believed such representations to be true.

(3) Whoever, with the intent—

(A) to promote the carrying on of specified unlawful activity;

(B) to conceal or disguise the nature, location, source, ownership, or control of property believed to be the proceeds of specified unlawful activity; or

(C) to avoid a transaction reporting requirement under State or Federal law,

conducts or attempts to conduct a financial transaction involving property represented to be the proceeds of specified unlawful activity, or property used to conduct or facilitate specified unlawful activity, shall be fined under this title or imprisoned for not more than 20 years, or both. For purposes of this paragraph and paragraph (2), the term “represented” means any representation made by a law enforcement officer or by another person at the direction of, or with the approval of, a Federal official authorized to investigate or prosecute violations of this section.

(b) Penalties.—

(1) In general.—Whoever conducts or attempts to conduct a transaction described in subsection (a)(1) or (a)(3), or section 1957, or a transportation, transmission, or transfer described in subsection (a)(2), is liable to the United States for a civil penalty of not more than the greater of—

(A) the value of the property, funds, or monetary instruments involved in the transaction; or

(B) $10,000.

(2) Jurisdiction over foreign persons.—For purposes of adjudicating an action filed or enforcing a penalty ordered under this section, the district courts shall have jurisdiction over any foreign person, including any financial institution authorized under the laws of a foreign country, against whom the action is brought, if service of process upon the foreign person is made under the Federal Rules of Civil Procedure or the laws of the country in which the foreign person is found, and—

(A) the foreign person commits an offense under subsection (a) involving a financial transaction that occurs in whole or in part in the United States;

(B) the foreign person converts, to his or her own use, property in which the United States has an ownership interest by virtue of the entry of an order of forfeiture by a court of the United States; or

(C) the foreign person is a financial institution that maintains a bank account at a financial institution in the United States.

(3) Court authority over assets.—

A court may issue a pretrial restraining order or take any other action necessary to ensure that any bank account or other property held by the defendant in the United States is available to satisfy a judgment under this section.

(4) Federal receiver.—

(A) In general.—

A court may appoint a Federal Receiver, in accordance with subparagraph (B) of this paragraph, to collect, marshal, and take custody, control, and possession of all assets of the defendant, wherever located, to satisfy a civil judgment under this subsection, a forfeiture judgment under section 981 or 982, or a criminal sentence under section 1957 or subsection (a) of this section, including an order of restitution to any victim of a specified unlawful activity.

(B) Appointment and authority.—A Federal Receiver described in subparagraph (A)—

(i) may be appointed upon application of a Federal prosecutor or a Federal or State regulator, by the court having jurisdiction over the defendant in the case;

(ii) shall be an officer of the court, and the powers of the Federal Receiver shall include the powers set out in section 754 of title 28, United States Code; and

(iii) shall have standing equivalent to that of a Federal prosecutor for the purpose of submitting requests to obtain information regarding the assets of the defendant—

(I) from the Financial Crimes Enforcement Network of the Department of the Treasury; or

(II) from a foreign country pursuant to a mutual legal assistance treaty, multilateral agreement, or other arrangement for international law enforcement assistance, provided that such requests are in accordance with the policies and procedures of the Attorney General.

(c) As used in this section—

(1) the term “knowing that the property involved in a financial transaction represents the proceeds of some form of unlawful activity” means that the person knew the property involved in the transaction represented proceeds from some form, though not necessarily which form, of activity that constitutes a felony under State, Federal, or foreign law, regardless of whether or not such activity is specified in paragraph (7);

(2) the term “conducts” includes initiating, concluding, or participating in initiating, or concluding a transaction;

(3) the term “transaction” includes a purchase, sale, loan, pledge, gift, transfer, delivery, or other disposition, and with respect to a financial institution includes a deposit, withdrawal, transfer between accounts, exchange of currency, loan, extension of credit, purchase or sale of any stock, bond, certificate of deposit, or other monetary instrument, use of a safe deposit box, or any other payment, transfer, or delivery by, through, or to a financial institution, by whatever means effected;

(4) the term “financial transaction” means (A) a transaction which in any way or degree affects interstate or foreign commerce (i) involving the movement of funds by wire or other means or (ii) involving one or more monetary instruments, or (iii) involving the transfer of title to any real property, vehicle, vessel, or aircraft, or (B) a transaction involving the use of a financial institution which is engaged in, or the activities of which affect, interstate or foreign commerce in any way or degree;

(5) the term “monetary instruments” means (i) coin or currency of the United States or of any other country, travelers’ checks, personal checks, bank checks, and money orders, or (ii) investment securities or negotiable instruments, in bearer form or otherwise in such form that title thereto passes upon delivery;

(6) the term “financial institution” includes—

(A) any financial institution, as defined in section 5312(a)(2) of title 31, United States Code, or the regulations promulgated thereunder; and

(B) any foreign bank, as defined in section 1 of the International Banking Act of 1978 (12 U.S.C. 3101);

(7) the term “specified unlawful activity” means—

(A) any act or activity constituting an offense listed in section 1961(1) of this title except an act which is indictable under subchapter II of chapter 53 of title 31;

(B) with respect to a financial transaction occurring in whole or in part in the United States, an offense against a foreign nation involving—

(i) the manufacture, importation, sale, or distribution of a controlled substance (as such term is defined for the purposes of the Controlled Substances Act);

(ii) murder, kidnapping, robbery, extortion, destruction of property by means of explosive or fire, or a crime of violence (as defined in section 16);

(iii) fraud, or any scheme or attempt to defraud, by or against a foreign bank (as defined in paragraph 7 of section 1(b) of the International Banking Act of 1978)); [1]

(iv) bribery of a public official, or the misappropriation, theft, or embezzlement of public funds by or for the benefit of a public official;

(v) smuggling or export control violations involving—

(I) an item controlled on the United States Munitions List established under section 38 of the Arms Export Control Act (22 U.S.C. 2778); or

(II) an item controlled under regulations under the Export Administration Regulations (15 C.F.R. Parts 730–774);

(vi) an offense with respect to which the United States would be obligated by a multilateral treaty, either to extradite the alleged offender or to submit the case for prosecution, if the offender were found within the territory of the United States; or

(vii) trafficking in persons, selling or buying of children, sexual exploitation of children, or transporting, recruiting or harboring a person, including a child, for commercial sex acts;

(C) any act or acts constituting a continuing criminal enterprise, as that term is defined in section 408 of the Controlled Substances Act (21 U.S.C. 848);

(D) an offense under section 32 (relating to the destruction of aircraft), section 37 (relating to violence at international airports), section 115 (relating to influencing, impeding, or retaliating against a Federal official by threatening or injuring a family member), section 152 (relating to concealment of assets; false oaths and claims; bribery), section 175c (relating to the variola virus), section 215 (relating to commissions or gifts for procuring loans), section 351 (relating to congressional or Cabinet officer assassination), any of sections 500 through 503 (relating to certain counterfeiting offenses), section 513 (relating to securities of States and private entities), section 541 (relating to goods falsely classified), section 542 (relating to entry of goods by means of false statements), section 545 (relating to smuggling goods into the United States), section 549 (relating to removing goods from Customs custody), section 554 (relating to smuggling goods from the United States), section 555 (relating to border tunnels), section 641 (relating to public money, property, or records), section 656 (relating to theft, embezzlement, or misapplication by bank officer or employee), section 657 (relating to lending, credit, and insurance institutions), section 658 (relating to property mortgaged or pledged to farm credit agencies), section 666 (relating to theft or bribery concerning programs receiving Federal funds), section 793, 794, or 798 (relating to espionage), section 831 (relating to prohibited transactions involving nuclear materials), section 844(f) or (i) (relating to destruction by explosives or fire of Government property or property affecting interstate or foreign commerce), section 875 (relating to interstate communications), section 922(l) (relating to the unlawful importation of firearms), section 924(n), 932, or 933 (relating to firearms trafficking), section 956 (relating to conspiracy to kill, kidnap, maim, or injure certain property in a foreign country), section 1005 (relating to fraudulent bank entries), 1006 [2] (relating to fraudulent Federal credit institution entries), 1007 [2] (relating to Federal Deposit Insurance transactions), 1014 [2] (relating to fraudulent loan or credit applications), section 1030 (relating to computer fraud and abuse), 1032 [2] (relating to concealment of assets from conservator, receiver, or liquidating agent of financial institution), section 1111 (relating to murder), section 1114 (relating to murder of United States law enforcement officials), section 1116 (relating to murder of foreign officials, official guests, or internationally protected persons), section 1201 (relating to kidnaping), section 1203 (relating to hostage taking), section 1361 (relating to willful injury of Government property), section 1363 (relating to destruction of property within the special maritime and territorial jurisdiction), section 1708 (theft from the mail), section 1751 (relating to Presidential assassination), section 2113 or 2114 (relating to bank and postal robbery and theft), section 2252A (relating to child pornography) where the child pornography contains a visual depiction of an actual minor engaging in sexually explicit conduct, section 2260 (production of certain child pornography for importation into the United States), section 2280 (relating to violence against maritime navigation), section 2281 (relating to violence against maritime fixed platforms), section 2319 (relating to copyright infringement), section 2320 (relating to trafficking in counterfeit goods and services), section 2332 (relating to terrorist acts abroad against United States nationals), section 2332a (relating to use of weapons of mass destruction), section 2332b (relating to international terrorist acts transcending national boundaries), section 2332g (relating to missile systems designed to destroy aircraft), section 2332h (relating to radiological dispersal devices), section 2339A or 2339B (relating to providing material support to terrorists), section 2339C (relating to financing of terrorism), or section 2339D (relating to receiving military-type training from a foreign terrorist organization) of this title, section 46502 of title 49, United States Code, a felony violation of the Chemical Diversion and Trafficking Act of 1988 (relating to precursor and essential chemicals), section 590 of the Tariff Act of 1930 (19 U.S.C. 1590) (relating to aviation smuggling), section 422 of the Controlled Substances Act (relating to transportation of drug paraphernalia), section 38(c) (relating to criminal violations) of the Arms Export Control Act, section 11 [3] (relating to violations) of the Export Administration Act of 1979, section 206 (relating to penalties) of the International Emergency Economic Powers Act, section 16 (relating to offenses and punishment) of the Trading with the Enemy Act, any felony violation of section 15 of the Food and Nutrition Act of 2008 (relating to supplemental nutrition assistance program benefits fraud) involving a quantity of benefits having a value of not less than $5,000, any violation of section 543(a)(1) of the Housing Act of 1949 (relating to equity skimming), any felony violation of the Foreign Agents Registration Act of 1938, any felony violation of the Foreign Corrupt Practices Act, section 92 of the Atomic Energy Act of 1954 (42 U.S.C. 2122) (relating to prohibitions governing atomic weapons), or section 104(a) of the North Korea Sanctions Enforcement Act of 2016 [3] (relating to prohibited activities with respect to North Korea);

environmental crimes

(E) a felony violation of the Federal Water Pollution Control Act (33 U.S.C. 1251 et seq.), the Ocean Dumping Act (33 U.S.C. 1401 et seq.), the Act to Prevent Pollution from Ships (33 U.S.C. 1901 et seq.), the Safe Drinking Water Act (42 U.S.C. 300f et seq.), or the Resources Conservation and Recovery Act (42 U.S.C. 6901 et seq.);

(F) any act or activity constituting an offense involving a Federal health care offense; or

(G) any act that is a criminal violation of subparagraph (A), (B), (C), (D), (E), or (F) of paragraph (1) of section 9(a) of the Endangered Species Act of 1973 (16 U.S.C. 1538(a)(1)), section 2203 of the African Elephant Conservation Act (16 U.S.C. 4223), or section 7(a) of the Rhinoceros and Tiger Conservation Act of 1994 (16 U.S.C. 5305a(a)), if the endangered or threatened species of fish or wildlife, products, items, or substances involved in the violation and relevant conduct, as applicable, have a total value of more than $10,000;

(8) the term “State” includes a State of the United States, the District of Columbia, and any commonwealth, territory, or possession of the United States; and

(9) the term “proceeds” means any property derived from or obtained or retained, directly or indirectly, through some form of unlawful activity, including the gross receipts of such activity.

(d) Nothing in this section shall supersede any provision of Federal, State, or other law imposing criminal penalties or affording civil remedies in addition to those provided for in this section.

(e) Violations of this section may be investigated by such components of the Department of Justice as the Attorney General may direct, and by such components of the Department of the Treasury as the Secretary of the Treasury may direct, as appropriate, and, with respect to offenses over which the Department of Homeland Security has jurisdiction, by such components of the Department of Homeland Security as the Secretary of Homeland Security may direct, and, with respect to offenses over which the United States Postal Service has jurisdiction, by the Postal Service. Such authority of the Secretary of the Treasury, the Secretary of Homeland Security, and the Postal Service shall be exercised in accordance with an agreement which shall be entered into by the Secretary of the Treasury, the Secretary of Homeland Security, the Postal Service, and the Attorney General. Violations of this section involving offenses described in paragraph (c)(7)(E) may be investigated by such components of the Department of Justice as the Attorney General may direct, and the National Enforcement Investigations Center of the Environmental Protection Agency.

(f) There is extraterritorial jurisdiction over the conduct prohibited by this section if—

(1) the conduct is by a United States citizen or, in the case of a non-United States citizen, the conduct occurs in part in the United States; and

(2) the transaction or series of related transactions involves funds or monetary instruments of a value exceeding $10,000.

(g) Notice of Conviction of Financial Institutions.—

If any financial institution or any officer, director, or employee of any financial institution has been found guilty of an offense under this section, section 1957 or 1960 of this title, or section 5322 or 5324 of title 31, the Attorney General shall provide written notice of such fact to the appropriate regulatory agency for the financial institution.

(h) Any person who conspires to commit any offense defined in this section or section 1957 shall be subject to the same penalties as those prescribed for the offense the commission of which was the object of the conspiracy.

(i) Venue.—

(1) Except as provided in paragraph (2), a prosecution for an offense under this section or section 1957 may be brought in—

(A) any district in which the financial or monetary transaction is conducted; or

(B) any district where a prosecution for the underlying specified unlawful activity could be brought, if the defendant participated in the transfer of the proceeds of the specified unlawful activity from that district to the district where the financial or monetary transaction is conducted.

(2) A prosecution for an attempt or conspiracy offense under this section or section 1957 may be brought in the district where venue would lie for the completed offense under paragraph (1), or in any other district where an act in furtherance of the attempt or conspiracy took place.

(3) For purposes of this section, a transfer of funds from 1 place to another, by wire or any other means, shall constitute a single, continuing transaction. Any person who conducts (as that term is defined in subsection (c)(2)) any portion of the transaction may be charged in any district in which the transaction takes place.

(j) Seven-year Limitation.—

Notwithstanding section 3282, no person shall be prosecuted, tried, or punished for a violation of this section or section 1957 if the specified unlawful activity constituting the violation is the activity defined in subsection (c)(7)(B) of this section, unless the indictment is found or the information is instituted not later than 7 years after the date on which the offense was committed.(a) Whoever, in any of the circumstances set forth in subsection (d), knowingly engages or attempts to engage in a monetary transaction in criminally derived property of a value greater than $10,000 and is derived from specified unlawful activity, shall be punished as provided in subsection (b).

(b)

(1) Except as provided in paragraph (2), the punishment for an offense under this section is a fine under title 18, United States Code, or imprisonment for not more than ten years or both. If the offense involves a pre-retail medical product (as defined in section 670) the punishment for the offense shall be the same as the punishment for an offense under section 670 unless the punishment under this subsection is greater.

(2) The court may impose an alternate fine to that imposable under paragraph (1) of not more than twice the amount of the criminally derived property involved in the transaction.

(c) In a prosecution for an offense under this section, the Government is not required to prove the defendant knew that the offense from which the criminally derived property was derived was specified unlawful activity.

(d) The circumstances referred to in subsection (a) are—

(1) that the offense under this section takes place in the United States or in the special maritime and territorial jurisdiction of the United States; or

(2) that the offense under this section takes place outside the United States and such special jurisdiction, but the defendant is a United States person (as defined in section 3077 of this title, but excluding the class described in paragraph (2)(D) of such section).

(e) Violations of this section may be investigated by such components of the Department of Justice as the Attorney General may direct, and by such components of the Department of the Treasury as the Secretary of the Treasury may direct, as appropriate, and, with respect to offenses over which the Department of Homeland Security has jurisdiction, by such components of the Department of Homeland Security as the Secretary of Homeland Security may direct, and, with respect to offenses over which the United States Postal Service has jurisdiction, by the Postal Service. Such authority of the Secretary of the Treasury, the Secretary of Homeland Security, and the Postal Service shall be exercised in accordance with an agreement which shall be entered into by the Secretary of the Treasury, the Secretary of Homeland Security, the Postal Service, and the Attorney General.

(f) As used in this section—

(1) the term “monetary transaction” means the deposit, withdrawal, transfer, or exchange, in or affecting interstate or foreign commerce, of funds or a monetary instrument (as defined in section 1956(c)(5) of this title) by, through, or to a financial institution (as defined in section 1956 of this title), including any transaction that would be a financial transaction under section 1956(c)(4)(B) of this title, but such term does not include any transaction necessary to preserve a person’s right to representation as guaranteed by the sixth amendment to the Constitution;

(2) the term “criminally derived property” means any property constituting, or derived from, proceeds obtained from a criminal offense; and

(3) the terms “specified unlawful activity” and “proceeds” shall have the meaning given those terms in section 1956 of this title.See also United States v. Boyle, (3rd Cir. 2021) 849 Fed. Appx. 325. See also United States v. Sanders, (5th Cir.) 952 F.3d 263.

- Same.

- Same. See, for example, Joint Law Enforcement Operation Results In Arrests And Federal Drug Trafficking And Money Laundering Charges, DOJ – U.S. Attorney’s Office – District of Nevada (July 14, 2021)

- Same.

- 18 U.S.C. § 3282.