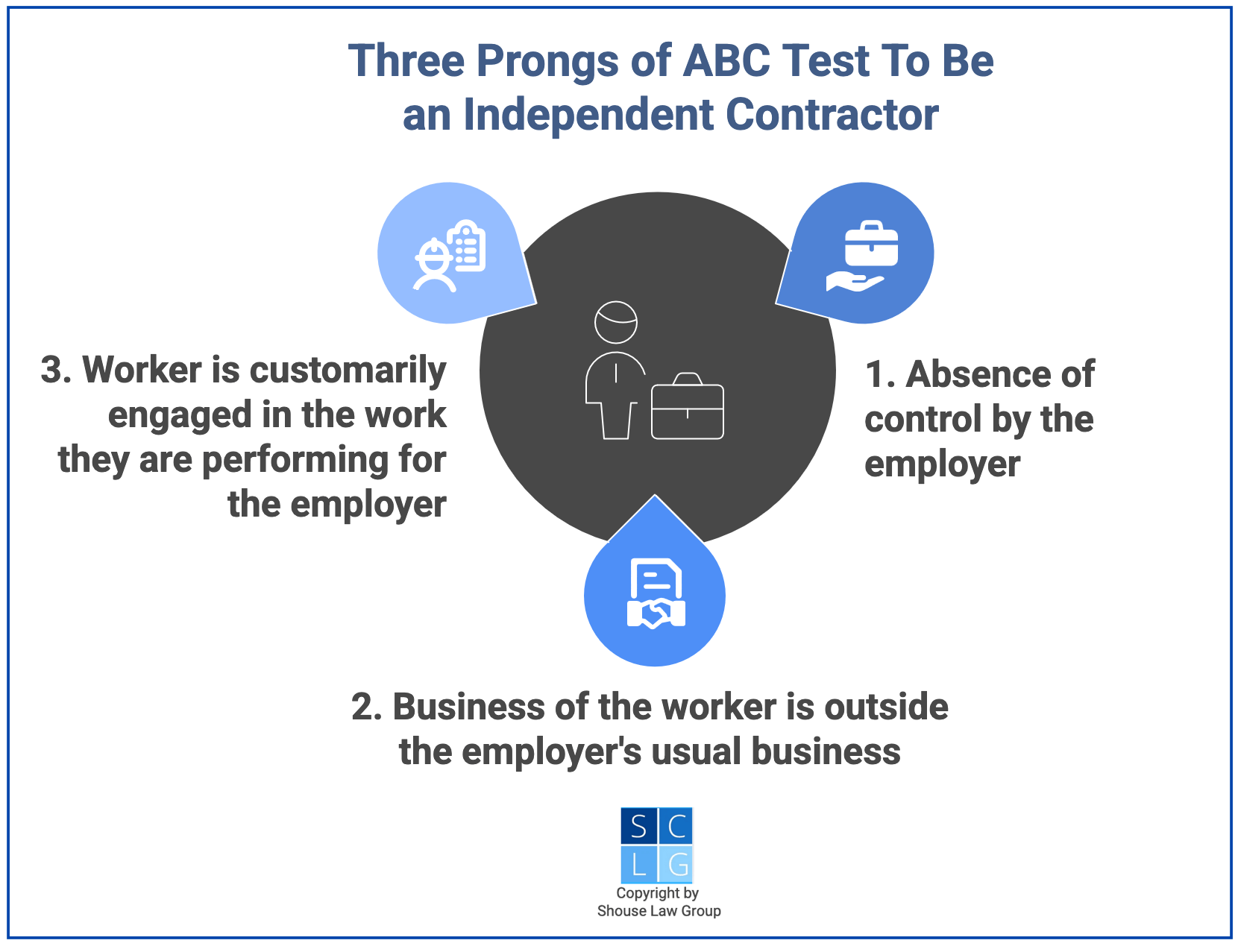

In California, the ABC test is one of the tests courts use to determine whether a worker or a vendor is actually an employee versus an independent contractor.

Unlike independent contractors, employees have the right to the following legal protections under state and federal employment law:

- overtime pay,

- the minimum wage, andg

- other employee benefits.

Companies are known to “misclassify” employees as independent contractors to avoid these obligations.

Under the ABC test, that law will deem you to be an employee unless:

- you are free from the employer’s control and direction regarding the performance of the work, both under the contract and in reality,

- you perform work outside the employer’s usual course of business, and

- You are customarily engaged in an independently established business that provides work of the same nature as the work being performed.

Not all independent contractor misclassification issues are resolved using the ABC test in California. Some cases require a more open-ended approach that considers the totality of the circumstances.

In this article, our California labor law attorneys will address everything you need to know about the ABC test.

How the ABC Test Works

California law generally uses the ABC test to distinguish between employees and independent contractors.

The ABC test looks past any contractual provisions between the company and the worker that define the worker’s status.1 Instead, the ABC test looks at the following three factors:

- Absence of Control: The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract and in fact; and

- Business of the Worker: The worker performs work that is outside the usual course of the hiring entity’s business; and

- Customarily Engaged: The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

Under the ABC test, courts presume that workers are employees. It is up to the hiring entity or purported employer to prove these three factors. You are an independent contractor only if the company can prove all three prongs. If they cannot, you are an employee.2

Each of these factors warrants careful examination.

However, the ABC test is not the only way to distinguish employees from independent contractors. Recent changes to the state’s labor code exempt certain occupations and business relationships from the ABC test.

In these exempted cases, courts rely on the older Borello test. It is a “totality of the circumstances” approach that looks at all relevant factors.3

A. Absence of Control

A key factor in the ABC test is the amount of control the purported employer has over the worker. The more control is exerted, the more likely the worker is an employee.4

It is not necessary for the hiring entity to control the precise manner or details of the work, though. It is up to the hiring entity to show that it is not exerting enough control to make the worker an employee.5

For example: A truck driver was an employee because the hiring entity required him to keep his truck clean, report to the dispatch center for assignments, and get prior approval before taking passengers. The hiring entity could also end the employment relationship if the driver was late, failed to contact dispatch, or violated the trucking company’s written policy.6

For example: Knitters and sewers were provided all the patterns and materials to make children’s clothing. Even though the workers were allowed to work at home at their own pace and hours, they were employees because they were given a pattern to follow and were expected to stick to it.7

For example: A construction company did not exert sufficient control over a historic restoration specialist who set his own schedule, worked without supervision, used his own business debit card to buy materials, and declined the company’s job offer so he could control his own work.8

B. Business of the Worker

Workers who provide services within the hiring entity’s usual course of business are employees. Others would ordinarily view these workers as employees of the company.9

For example: A bakery that hires cake decorators to work on its customized cakes on a regular basis would be hiring employees.10

For example: A bakery that hires a plumber to repair a leak in the store’s bathroom would be hiring an independent contractor.11

If labor laws allowed workers to provide their services as independent contractors and to waive their legal protections, true employees would quickly be displaced from the job site. This would also pressure competing companies to do the same, reducing wages, job security, and workplace safety.12

C. Customarily Engaged

Hiring entities have to show that alleged employees independently decided to customarily engage in an independently established trade or occupation of their own to provide the services rendered. It does not suffice for the employer to show that it merely did not prevent the worker from engaging in such a business.13

The phrase “independent contractor” generally describes workers who have chosen to go into business for themselves.14

For example: A construction company hired siding installers, who provided their own tools. However, the installers had no instrumentalities of a business, like a business location or a business phone number, and did not receive income from anyone other than the construction company. The siding installers were employees.15

For example: A group of auto repair appraisers had home offices and business cards, their own licenses to operate, provided their own equipment, and were soliciting business from other companies. The company that hired them was not necessarily their employer solely because the appraisers had not worked for any other businesses.16

ABC Test Exemptions

Dozens of types of workers are exempt from the ABC test in most circumstances. Some of the most important of these exemptions are for:

- creative artists and entertainers,17

- most individuals providing feedback to data aggregators,18

- insurance underwriters, auditors, and risk managers,19

- medical professionals like doctors, surgeons, dentists, and veterinarians,20

- certain licensed professionals,21

- registered securities broker-dealers,22

- most direct salespeople,23

- newspaper distributors and carriers,24

- grant writers,25

- graphic designers,26

- marketers,27

- travel agents,28

- real estate appraisers,29 and

- freelance writers or editors.30

Additionally, the ABC test does not apply to working relationships between:

- most bona fide business-to-business contracting relationships,31

- most referral agencies and service providers,32

- workers providing certain professional services to hiring entities,33

- two individuals or entities performing work pursuant to a contract that only covers a single engagement,34 and

- certain construction contractors and individuals performing work as subcontractors.35

Workers who are exempted from the ABC test are subject to the older Borello test to determine their proper employee status.36

Changes in the Law

In 1989, the California Supreme Court created the Borello test to resolve misclassification disputes.37 However, the multifactor Borello test was difficult to use because it accounted for all the factors at play. Without more guidance, employers and workers struggled to determine their employment status. 38

In 2018, the California Supreme Court adopted the ABC test, which several other states rely on to solve independent misclassification issues. California’s version of the ABC test is similar to Massachusetts’. 39

The following year, the California Legislature passed Assembly Bill 5 to codify the ABC test. However, it also carved out numerous occupations that continue to be handled by the Borello test. Then in 2020, the Legislature passed Assembly Bill 2257 in 2020, which exempted even more occupations from the ABC test.40

Most recently, the California Supreme Court upheld Proposition 22, which creates a specific carve-out from AB 5 for ride-sharing and delivery companies like Uber, Lyft, and Postmates. So under Prop 22, these companies can classify their drivers as independent contractors rather than employees.41

Employee vs. Independent Contractor

Employees are protected by numerous provisions of California’s labor laws and wage orders. Independent contractors are not. The following table outlines the most important differences between these two.

|

Employees… |

Independent Contractors… |

| Are entitled to the applicable minimum wage | Are not |

| Are entitled to overtime pay if they are non-exempt | Are not |

| Are entitled to meal and rest breaks if they are non-exempt | Are not |

| Have taxes withheld from their earnings | Pay their own taxes |

| Have their employers pay half of their Social Security and Medicare tax | Pay 100 percent of the Social Security and Medicare taxes owed to the IRS |

| Are entitled to employee benefit programs, including healthcare insurance and retirement benefits | Must provide their own retirement and health insurance |

| Are covered by workers’ compensation | Have to provide their own workers’ compensation |

| Generally use equipment provided by their employer | Provide their own equipment |

| Can hold their employer vicariously liable for accidents caused by the employee’s negligence while on the job | Is liable for accidents they cause |

| Can recover compensation for any business expenses they incur | Cover the costs of their own business expenses |

| Can receive unemployment insurance benefits | Cannot receive unemployment |

| Are paid with a W-2 form | Receive 1099 forms for work performed |

Remedies for Misclassified Employees

If you have been misclassified as an independent contractor in California, you can file a:

- misclassification lawsuit against your purported employer, or

- claim with the Labor Commissioner at the California Division of Labor Standards Enforcement (DLSE).

These claims can demand:

- compensation for unpaid wages and other benefits that the employer deprived you of,

- interest on that amount, and

- attorney’s fees.

If your employer willfully misclassifies you as an independent contractor, they may be subjected to a civil penalty of between $5,000 and $25,000 per violation.42

The statute of limitations for filing wage and hour claims in California law is three years. If the claim is for a breach of contract, you must file it within four years.43

Additional Resources

For more information, refer to the following:

- Who’s an Independent Contractor? Who’s an Employee? – Scholarly article in The Labor Lawyer.

- Independent Contractor Defined – Summary by the Internal Revenue Service (IRS).

- What is an Independent Contractor – Overview from Business News Daily.

- Misclassification of Employees as Independent Contractors – Discussion by the U.S. Department of Labor, Wage and Hour Division.

- Independent Contractor Status Under the Fair Labor Standards Act – In-depth discussion from the Federal Register.

Legal References:

- Espejo v. The Copley Press, Inc. (2017) 13 Cal.App.5th 329. See also ABC Test, California Department of Labor.

- California Labor Code 2775 LAB. See also California Civil Jury Instructions (CACI) No. 2705. See also, for example, Bowen v. Burns & McDonnell Engineering Co., Inc. (Cal.App. 2024) 103 Cal. App. 5th 759.

- S.G. Borello & Sons, Inc. v. Department of Industrial Relations (1989) 48 Cal.3d 341. Some of those factors of the Borello test are:

- whether the worker is in a distinct occupation or business,

- whether the type of work normally happens under the direction of the employer or by a specialist without supervision,

- how much skill is necessary for the work,

- who supplies the tools and workspace,

- whether or how much the worker invested in their tools or helpers,

- how long the services will be performed,

- whether the worker is compensable based on time spent on the job or upon the job’s completion,

- whether the work is within the purported employer’s regular business,

- whether the parties believe that they are creating an employer-employee relationship, and

- whether the worker can profit or lose from the work based on their managerial skill.

- California Labor Code 2775(b)(1)(A) LAB.

- Dynamex Operations West, Inc. v. Superior Court of Los Angeles County (2018) 4 Cal.5th 903, 958. See also Vazquez v. Jan-Pro Franchising Internat. (2021) 10 Cal. 5th 944.

- Dynamex, supra note 5, citing Western Ports v. Employment Security Department (Wash.App. 2002) 41 P.3d 510.

- Dynamex, supra note 5, citing Fleece on Earth v. Department of Employment & Training (2007) 181 Vt. 458.

- Dynamex, supra note 5, citing Great Northern Construction, Inc. v. Dept. of Labor (Vt. 2016) 161 A.3d 1207.

- Dynamex, supra note 5, at 959-961.

- Dynamex, supra note 5, citing Dole v. Snell (10th Cir. 1989) 875 F.2d 802.

- Dynamex, supra note 5, at 959.

- Alamo Foundation v. Secretary of Labor (1985) 471 U.S. 290.

- Dynamex, supra note 5, at 961-3.

- Dynamex, supra note 5, at 962. Going into business for oneself often involves taking the following steps: incorporating as a business, advertising, obtaining any necessary business licenses, and making offers to provide business services to the public.

- Dynamex, supra note 5, citing Brothers Construction Co. v. Virginia Employment Commission (Va.App. 1998) 494 S.E.2d 478.

- Dynamex, supra note 5, citing Southwest Appraisal Group, LLC v. Administrator, Unemployment Comp. Act (Conn. 2017) 155 A.3d 738.

- California Labor Code 2780 LAB. Examples include recording artists or their managers, songwriters, lyricists, composers, or proofers, record producers and directors, musical engineers and mixers, musicians and musical groups, vocalists, and photographers working in the music industry.

- California Labor Code 2782 LAB.

- California Labor Code 2783 LAB.

- Same.

- Same. The licensed professionals include lawyers, architects and landscape architects, engineers, accountants, and private investigators.

- Same.

- Same.

- Same.

- California Labor Code 2778 LAB.

- Same.

- Same.

- Same.

- Same.

- Same.

- California Labor Code 2776 LAB.

- California Labor Code 2777 LAB.

- California Labor Code 2778 LAB.

- California Labor Code 2779 LAB.

- California Labor Code 2781 LAB.

- See note 3.

- Same.

- Dynamex, supra note 5, at 954.

- Dynamex, supra note 5, at 956, footnote 23.

- California Labor Code 2785 LAB.

- Daniel Wiessner, 9th Circuit weighs claims that Uber was targeted by Calif. contractor law, Reuters (March 20, 2024). Alexander T. MacDonald, California Supreme Court Upholds Prop 22, Allows App-Based Drivers to Keep Working as Contractors, The Federalist Society (February 11, 2025).

- California Labor Code 226.8 LAB.

- California Code of Civil Procedure 338 CCP; California Code of Civil Procedure 337 CCP. While independent contractors do not enjoy these legal and financial benefits, they have more control in how they work. True independent contractors can: choose which days and hours to work, choose and use their own equipment, and take breaks whenever they want. Actual independent contractors only have to satisfy the companies that they contract with in the products and services that they provide. True independent contractors cannot be told how to provide them. They are central to the current gig economy. This is why independent contractor misclassification is a problem in employment law: Employers classify workers as independent contractors but treat them as employees. By doing so, they can control the work that is provided while also avoiding the legal obligations that are owed to employees.